News24.com | Wage freeze, tax hikes or borrowing – how will Treasury ‘make sure’ there is money for vaccines?

- President Cyril Ramaphosa previously said Treasury would ensure that funding is available to secure vaccines.

- Economists do not foresee dramatic tax hikes to fund vaccines. However, increases to fuel levies and even a wealth tax are on the cards.

- Treasury says it will announce any tax changes and detailed financing measures on budget day.

President Cyril Ramaphosa has ambitious plans to have 40 million South Africans receive Covid-19 vaccines by the end of the year and Treasury is going to have to foot the bill with state coffers which are already stretched to their limits.

Last week in an interview with EWN, the president said that Treasury would ensure that money is available for vaccines. “There can never be any talk that we don’t have money for the vaccine to save the lives of our people. The money is going to be there and Treasury is going to make sure that the money is there,” he told journalists.

The interview followed the president’s address to the nation earlier last week, where he explained there would be three channels by which vaccines would be acquired. These are – the World Health Organisation’s COVAX facility, the African Union’s vaccine initiative and through direct engagements with vaccine manufacturers. He said 20 million vaccines are to be distributed in the first half 2021.

By comparison, Israel has already provided single doses of vaccines to one in four people, the UAE is tailing with 19% of its population vaccinated, followed by Bahrain and the UK, the Bureau for Economic Research noted in a weekly update. So far, the US has vaccinated just under 4% of its population.

But how exactly will Treasury be funding vaccines – with an already pressured fiscus?

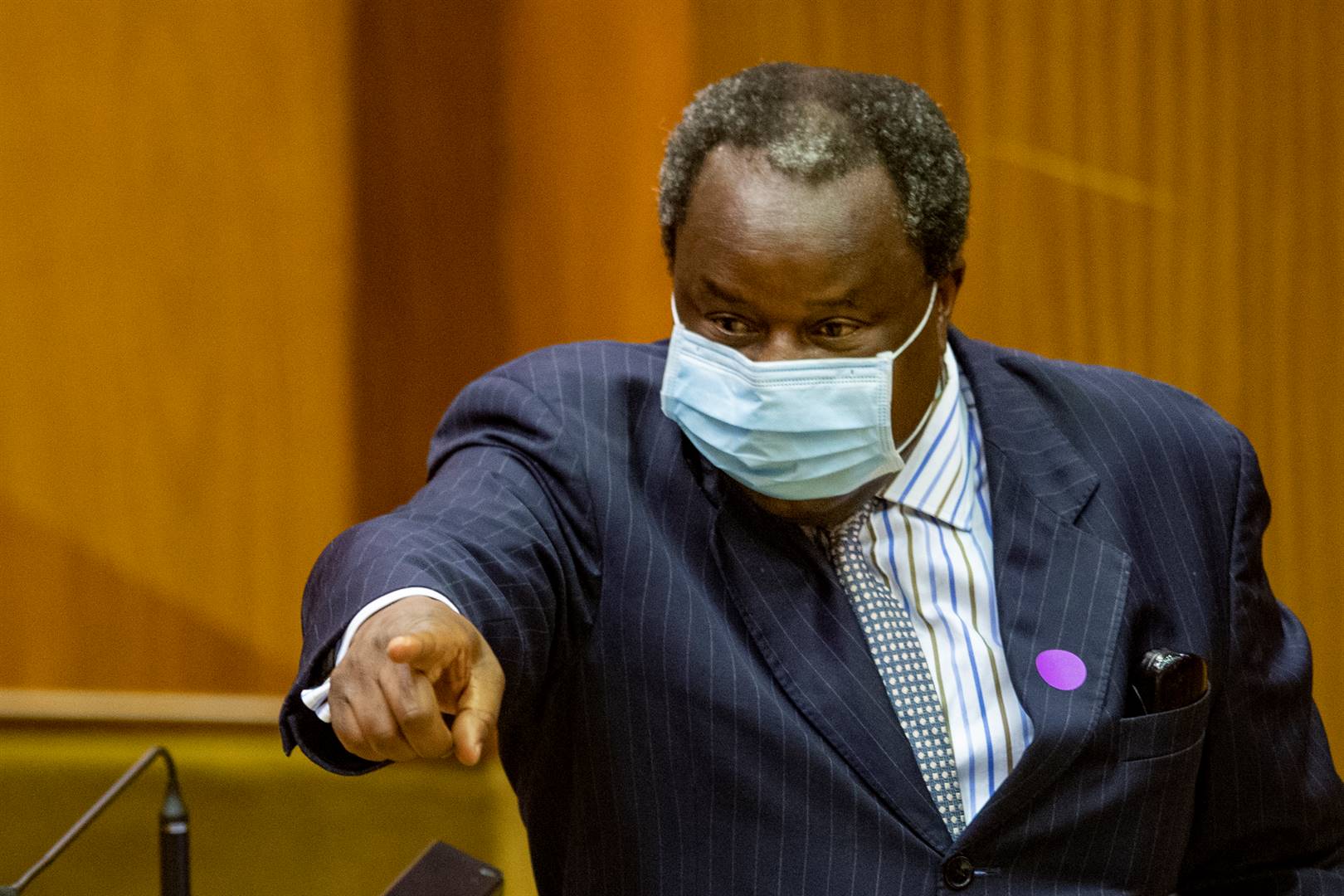

In an emailed response to questions from Fin24, Treasury said that “detailed financing measures”, including tax changes, will be announced on Budget Day, in February. However, citing Treasury’s Director-General Dondo Mogajane, Business Day reported that tax hikes are being considered, along with other measures. Mogajane directed Fin24 to Treasury’s media team for questions.

In response to the report, opposition party the Democratic Alliance issued a statement labelling any tax hikes by Treasury to fund Covid-19 vaccines as “morally indefensible” and a “bad economic policy”. The DA’s Geordin Hill-Lewis, during a media briefing on Monday, said it would be better for government to reprioritise spending from “wasteful programmes” and cancel “wasteful bailouts.”

Economists however do not think Treasury will be too aggressive with tax hikes this year, especially at such a crucial point where the economy is in recovery.

Difficult choices

Chief economist of the Bureau for Economic Research Hugo Pienaar explained that Treasury could consider a combination of expenditure reprioritisation and raising taxes to fund vaccines. He noted that last year Treasury already had to reprioritise expenditure to fund the Covid-19 fiscal relief package. “In this environment, Treasury should rather reprioritise expenditure even more. It will be difficult, they have already cut back a lot of other expenditure… But that may be the preferred option as opposed to raising taxes.”

Pienaar expects there to be adjustments to fuel levies and even sin taxes. But he does not foresee government raising VAT, which will be hard on consumers who are already battling retrenchments and in some cases salary cuts due to the Covid-19 lockdown.

Other income support measures from government have also lapsed or coming to an end such as the UIF- Temporary Employee/Employer Relief Scheme and social grant top-ups, Pienaar explained. “To increase VAT would be quite a dramatic step for them (Treasury),” said Pienaar. Increasing VAT would also compromise the economic recovery even more, so Treasury would probably be hesitant about that, he added

At the October Medium Term Budget Policy Statement (MTBPS) last year, Treasury had already indicated that it planned to raise a further R5 billion taxes in the 2021/2022 financial year. Pienaar said that Treasury probably would not want to increase the burden on consumers even more.

Another option for Treasury to take is to breach the expenditure ceiling in order to pay for the vaccines, said Pienaar. This will widen the budget. Government would then have to increase its borrowing – which is also undesirable because the country’s debt to GDP is north of 80% or about R4 trillion.

Finance Minister Tito Mboweni warned multiple times last year that the country is at risk of a sovereign debt crisis – which must be avoided.

Momentum Investments economist Sanisha Packirisamy highlighted that revenue raised from the auctioning of spectrum as well as bolstered revenues from mining on the back of improved commodity prices– as outlined in the MTBPS – could possibly aid vaccine funding requirements.

As for generating revenue by raising taxes, Packirisamy said this would be difficult given “sluggish growth and ongoing consumer and business stress” due to the negative effects of the Covid-19 pandemic on the economy. The SA economy is expected to have contracted between 7% and 13% in 2020 – the worst performance in 90 years.

“If we look at the potential sources of revenue, we would see fiscal drag and fuel levies as the most prominent sources of additional revenue generation capacity,” said Packirisamy. Fiscal drag is a concept in which inflation or income growth would move taxpayers to higher tax brackets – essentially they would be paying more taxes without government explicitly raising taxes.

Packirisamy also highlighted that government could raise sin taxes-but recently the alcohol industry has asked for a deferment of excise duties in light of the alcohol sales ban, Fin24 previously reported.

Packirisamy noted that raising wealth taxes is possible and could be addressed as a potential source of revenue, although it is unlikely to be a major source of revenue given the country’s massive inequality. “SA faces extreme wealth inequality and as such the base targeted under a wealth tax would be narrow, limiting collections. Moreover, there is a significant administrative burden to collecting wealth taxes particularly if it is focused as a tax on luxury goods (luxury vehicles, art and jewellery).”

Packirisamy foresees a low likelihood in personal income taxes being raised. This source of government revenue is already negatively impacted by emigration, increasing unemployment, pay cuts and poor economic growth, she said. There is also a low likelihood for corporate income tax rates to be increased. It is already high at 28% compared to the global average of 23.6%, Packirisamy explained.

There could be scope for government to raise savings, through negotiations on salary increases for civil servants. “A moribund economy lowers the bargaining power of the labour unions in our view, with the risk of further job losses looming,” said Packirisamy.

“The finance ministry is likely to take a tough stance given the financing constraints government faces. Negative real increases in the government wage bill would be a positive for fiscal consolidation, but there is likely to be slippage given the rise in food and oil prices, which the labour unions will raise in their argument for higher wages.”

Investec chief economist Annabel Bishop said that the largest savings could be derived from the civil service remunerations. “Aligning the civil service to the private sector from a wage change perspective is vital to allow for the space to spend on necessary items like vaccines, as opposed to luxuries such as above inflation increase in the renumeration of public servants,” said Bishop.

“At R54 a vaccine, they would need about R2.15 billion and these saving can easing be made if the civil service sees a zero percent change in renumeration in 2020 and 2021 as is appropriate in the ongoing state of emergency the country finds itself in,” Bishop added.