DA chief whip Natasha Mazzone (Jan Gerber/News24)

The DA will report the ministers and deputy ministers who allegedly received money from tenderpreneur Edwin Sodi to Parliament’s Joint Committee on Ethics and Members’ Interests.

On Tuesday, Sodi testified before the Zondo commission of inquiry into state capture that Health Minister Zweli Mkhize, in his former capacity as ANC treasurer-general, Employment and Labour Minister Thulas Nxesi, State Security Deputy Minister Zizi Kodwa and Deputy Communications Minister Pinky Kekana, amongst others, received payments from him between 2013 and 2019.

“The DA ran an extensive check of Parliament’s register of members’ interests for the period these payments were made. None of the individuals mentioned during Sodi’s session with the commission declared such payments,” DA chief whip Natasha Mazzone said in a statement.

“This is a direct contravention of Section 5 of Parliament’s Code of Ethical Conduct and Disclosure of Members’ Interests regarding Conflict of Financial or Business Interests.”

Section 5.1.1 of the code required members to “resolve any financial or business conflict of interest in which he or she is involved in his or her capacity as a public representative, in favour of the public interest; and 5.1.2 always declare such interest, and where appropriate, the Member should recuse himself or herself from any forum considering or deciding on the matter”.

ALSO READ | State capture inquiry: Director says his company did not have ‘expertise’ to handle asbestos

“While there is little doubt that these Members of Parliament will offer all manner of excuses to explain away their dirty hands, the fact is that if their dealings with Sodi were irreproachable, they would have had no qualms declaring these payments,” Mazzone said.

“As it stands, none of the excuses they can come up with will suffice. The Ethics Committee is duty-bound to investigate this matter and should do so urgently. And the DA expects more than a mere slap on the wrist – as is the current trend – for these perpetrators of dark deeds if South Africa is ever to wipe corruption completely from its slate.”

Sodi’s company, Blackhead Consulting, obtained a R255 million asbestos contract from the Free State provincial administration in 2014. The contract was found to have been irregular by the Auditor-General and Public Protector.

On Monday, Free State Human Settlements HOD Nthimotse Mokhesi testified before the Zondo commission that entered into a trust to own a residential property with Sodi. This, while the department was still making payments on the contract, despite the AG’s finding.

On Wednesday, the Hawks arrested two persons involved in the asbestos contract – the first arrests flowing from the commission.

The Hawks have arrested six people in connection with the controversial contract.

PHOTO: Felix Dlangamandla, Gallo Images, Netwerk24

The DA says the arrests in connection with an unlawful R255 million Free State asbestos contract are just the tip of the iceberg.

The Hawks on Wednesday arrested six out of seven people in connection with the controversial 2014 contract.

One of those reportedly arrested is ousted Mangaung mayor Olly Mlamleli.

DA chief whip Natasha Mazzone said the arrests were a step in the right direction.

“Those who were bribed need to be brought to book. We need to see who got paid to determine who else might be involved. I think we are also just scratching the surface.

“This syndicate had their finger literally in every pie. Former Minister Zwane’s admission that he was incompetent is also very worrisome. The fish rots from its head. The corruption goes to the highest of the ruling party,” she added.

READ | Free State asbestos case: Ousted Mangaung mayor among those arrested, ANC to have urgent meeting

Meanwhile, Blackhead Consulting CEO Edwin Sodi made his second appearance before the Zondo commission into allegations of state capture this week to give evidence on a handful of suspicious payments to high-profile politicians and government staffers from his company.

This included Deputy State Security Minister Zizi Kodwa, who was the ANC’s spokesperson at the time.

Sodi claimed the payments were favours for friends and were not intended to secure contracts.

The former head of the Free State human settlements department, Nthimotse Mokhesi, also testified this week that he had received more than R600 000 from Sodi’s company.

Cope spokesperson Dennis Bloem said he had hoped the arrests and further investigation would bring those involved to book.

“We are happy that at least there are moves from the Zondo commission. Law enforcement agencies must get to those involved as we have always said they need to act against those who steal.

“This must also not be a publicity stunt, we want to see results and we want to see those involved in orange overalls. Things can’t go on like this,” he added.

ALSO READ | State capture: Free State official owns a house with beneficiary of ‘irregular’ contract

Wouter Wessels of the FF Plus said the Free State’s coffers have been emptied due to corruption and state capture.

“We believe that it is not only officials that were involved with corrupt transactions, tender fraud and other malpractices with government funds should be punished, but also the politicians behind it.

“These arrests are, however, the tip of the iceberg and much stronger action would be necessary to hold the high-ranking politicians that are behind the looting of the Free State’s funds.

“There are several other projects, similar to the asbestos audit, where millions of rand were squandered as a result of fraud and corruption,” he added.

Wessels said projects like the Vrede Dairy investigation saw former officials of provincial departments prosecuted while high-ranking officials of the ANC were still free.

The ANC in the Free State is reportedly set to meet to deliberate on the arrests.

Willem Breytenbach outside court in Cape Town.

PHOTO: Murray Williams, News24

Outstanding statements in the case against alleged child rapist and sex assault accused Willem Breytenbach saw the matter again postponed in the Cape Town Regional Court on Tuesday.

The former teacher and journalist made a brief appearance in the dock, where the case was postponed to 17 November to deal with the outstanding documents and allow for further legal consultations.

Breytenbach, dressed in a black suit, hurried out of the court building following his appearance.

He stands accused of raping or sexually abusing boys between 1983 and 2019.

READ | Willem Breytenbach case: 41 men claim they were sexually abused, youngest alleged victim was 12

He formally faces six charges of indecent assault and one of sexual assault, News24 previously reported.

In November 2019, Johannesburg-based copywriter Deon Wiggett and News24 co-published a series of podcasts called My Only Story, in which Wiggett exposed Breytenbach as an alleged sexual predator.

It ultimately led to his arrest on 3 December at his mother’s house in Reebok, a small town near Mossel Bay in the Southern Cape.

He is out on bail.

Did you know you can comment on this article? Subscribe to News24 and add your voice to the conversation.

Former crime intelligence boss Richard Mdluli is seen outside the Gauteng High Court in Johannesburg.

Felix Dlangamandla, Gallo Images, Netwerk24

Former crime intelligence boss Richard Mdluli and his co-accused Mthembeni Mthunzi have been sentenced to an effective five years in jail for the 1999 kidnapping and assault of Oupa Ramogibe.

In 2019, the two were convicted of assaulting and kidnapping Mdluli’s former lover, Tshidi Buthelezi, her husband, Ramogibe, and a friend Alice Manana in 1998.

READ | Ex-Crime Intelligence boss Richard Mdluli’s sentencing postponed for a month

Mthunzi and Mdluli were colleagues at the time of the incident.

In delivering the sentence in the Gauteng High Court in Johannesburg on Tuesday, Judge Ratha Mokgoatlheng said Mdluli and Mthunzi abused the power and authority entrusted in them as senior policemen.

Mokgoatlheng said the only appropriate sentence for the accused was a custodial sentence.

Both Buthelezi and Ramogibe have since died. Buthelezi died from an illness while Ramogibe was gunned down in 1999.

More to follow.

Did you know you can comment on this article? Subscribe to News24 and add your voice to the conversation.

The real output of the secondary sector contracted even more than the primary sector in the second quarter of 2020. The sharp and broad-based decrease in manufacturing output subtracted the most of all sectors from overall GDP growth, at 10.8 percentage points. The decline in both electricity consumption and production reflected the sharp contraction in economic activity in the electricity-intensive mining and manufacturing sectors, while water consumption also declined. The real GVA by the construction sector decreased the most of all sectors in the second quarter of 2020, at 76.6%, as the national lockdown brought almost all construction activity to a halt.

The real output of the usually fairly stable tertiary sector also contracted sharply in the second quarter of 2020. The pronounced decline in the real GVA by both the commerce and the transport sectors largely reflected the restrictions on non-essential purchases and travel during the national lockdown. The real GVA by the finance, insurance, real estate and business services sector also decreased notably in the second quarter of 2020 – the first contraction since the second quarter of 2009, in the aftermath of the global financial crisis.

Real gross domestic expenditure (GDE) shrank for the fourth consecutive quarter in the second quarter of 2020, mirroring the contractions in real GDP over this period. All of the expenditure components subtracted from growth in real GDP in the second quarter of 2020. In particular, real gross fixed capital formation and real final consumption expenditure by households decreased significantly, alongside a fourth successive quarterly de-accumulation in real inventory holdings – the largest ever recorded – as well as real net exports, with global trade severely affected by COVID-19.

The sharp contraction in household consumption expenditure in the second quarter of 2020 reflected reduced real outlays on all categories. Spending on durable and semi-durable goods contracted the most, as these goods were mostly classified as non-essential during the lockdown, with sales prohibited. The real disposable income of households also contracted in the second quarter of 2020, as the compensation of employees declined amid job losses and reduced salary payments during the lockdown.

Household debt declined in the second quarter of 2020, for the first time since the third quarter of 2002. The outstanding balances of most categories of credit extended to households decreased as the national lockdown and related uncertainty likely affected households’ saving and spending patterns. However, the ratio of household debt to nominal disposable income increased significantly from 73.6% in the first quarter of 2020 to 85.3% in the second quarter, as the notable quarter-to-quarter decline in nominal disposable income exceeded the decline in household debt. Households’ net wealth increased notably in the second quarter of 2020, as the recovery in share prices after the sharp initial correction boosted the value of equity portfolios. The FTSE/JSE All-Share Price Index (Alsi) increased by 47.7% from a recent low on 19 March 2020 up to 11 September, in line with most international bourses.

Real gross fixed capital formation registered the largest contraction on record in the second quarter of 2020 following already sizeable contractions in the preceding two quarters. Real capital investment by both the private sector and public corporations declined steeply in the second quarter, while capital spending by general government decreased only slightly. Reduced spending on transport equipment was especially pronounced as new vehicle sales plummeted to an all-time low in April, with dealerships not allowed to operate under level 5 of the lockdown restrictions. In addition, infrastructure projects were delayed and interrupted by inaccessible project sites and restrictions on the use of essential amenities such as transport during the lockdown.

The national saving rate declined markedly from 15.8% in the first quarter of 2020 to 10.7% in the second quarter. This resulted from a marked increase in dissaving by general government, as revenue fell sharply across all major tax categories in the second quarter of 2020.

The effect of the COVID-19-related lockdown is not yet visible in the official labour market statistics, as the release of Statistics South Africa’s (Stats SA) household-based

Quarterly Labour Force Survey for the second quarter of 2020 has been delayed following lockdown-related logistical and methodological complications. The number of unemployed South Africans had already increased significantly in the year to the first quarter of 2020 due to a surge in the number of new and re-entrants into the labour market who failed to find employment. The official unemployment rate increased to a record high of 30.1% in the first quarter of 2020, reflecting the impact of the economic recession that had already started in the third quarter of 2019. Growth in the formal non-agricultural nominal remuneration per worker was restrained by the recessionary conditions in the first quarter of 2020, with remuneration growth slowing in both the public and the private sector. Year-on-year growth in nominal unit labour cost in the formal non-agricultural sector moderated to 4.5% in the first quarter of 2020, while labour productivity continued to contract. Both headline producer and consumer price inflation moderated to historical lows in May 2020 in the wake of the COVID-19 pandemic, mostly due to a significant decrease in fuel prices as the shutdown of economic activity in most economies supressed the demand for crude oil. The lockdown restrictions aimed at containing the spread of COVID-19 required methodological changes to the compilation of the consumer price index (CPI), which introduced some temporary downward statistical bias. Headline CPI inflation then accelerated from a 16-year low of 2.1% in May 2020 to 3.2% in July, as fuel prices decreased at a slower year-on-year rate and as the extent of price imputations by Stats SA diminished. Underlying inflationary pressures receded further during the first half of 2020, reflective of muted price pressures amid the domestic recessionary conditions. World trade volumes decreased notably further in the second quarter of 2020, reflecting the sharp contraction in output in many countries following production stoppages and with ports operating at reduced capacity. The adverse effects of this were also visible in South Africa’s trade surplus, which more than halved from the first to the second quarter of 2020, as the value of net gold and merchandise exports contracted much more than merchandise imports. Mining and manufacturing exports contracted sharply in the second quarter of 2020 while agricultural exports increased, supported by citrus exports in particular. The value of merchandise imports contracted for a fourth consecutive quarter as most of the mining and manufacturing subcategories declined. The value of crude oil imports decreased sharply due to the marked decline in the average realised rand price per barrel and, to a lesser extent, lower volumes. South Africa’s terms of trade improved further to a record high in the second quarter of 2020 as the rand price of exports increased while that of imports decreased. The shortfall on the services, income and current transfer account widened significantly in the second quarter of 2020 as the deficits of all three sub-accounts widened. In particular, the deficit on the services account widened substantially due to the unusual circumstances brought about by the COVID-19-related international travel restrictions. Consequently, the balance on the current account of the balance of payments reverted from a surplus of 1.2% of GDP in the first quarter of 2020 – the only surplus since the first quarter of 2003 – to a deficit of 2.4% in the second quarter. The net flow of capital on South Africa’s financial account of the balance of payments reverted from an inflow of R16.6 billion in the first quarter of 2020 to an outflow of R10.3 billion in the second quarter. On a net basis, direct investment, financial derivatives and reserve assets recorded inflows during the second quarter, while portfolio and other investment recorded outflows. Portfolio investment flows largely reflected non-resident net sales of South African debt securities, as well as the redemption of international bonds by national government. This was partly countered by South African residents’ disposal of foreign portfolio assets. Despite a further decrease in South Africa’s international reserve assets in the second quarter of 2020, the level of import cover rose to a new all-time high of 8.0 months at the end of June, reflecting the continued decline in imports. South Africa’s positive net international investment position (IIP) increased more than threefold from the end of December 2019 to the end of March 2020, reflecting a notable increase in the market value of foreign assets and a further decline in foreign liabilities. The decrease in the nominal effective exchange rate (NEER) of the rand of 19.3% over this period affected foreign assets more than foreign liabilities, while divergent movements in some asset prices also contributed to the significant increase in the positive net IIP. The NEER increased by 2.7% in the second quarter of 2020 following the notable decrease in the first quarter, as investor sentiment improved amid the gradual lifting of lockdown restrictions and further monetary policy easing in several countries, including South Africa. The NEER increased marginally further up to mid-September as domestic developments, such as the resumption of electricity load-shedding and the larger-than-expected contraction in real GDP in the second quarter of 2020, were offset by the continued appreciation of the rand against the United States (US) dollar. The movements in South African government bond yields thus far in 2020 have reflected uncertainty as to the economic impact of the COVID-19 pandemic and the concomitant changes in South Africa’s sovereign and currency risk premiums, as well as net sales of bonds by non-residents and fluctuations in the exchange value of the rand. Bond yields also reflected concerns about the sustainability of South Africa’s public finances against the backdrop of an increase in government debt, as projected in the June 2020 Supplementary Budget. The decline in domestic short-term money market interest rates in the first half of 2020 continued after the further reduction in the repurchase (repo) rate in July. Growth in the broadly defined money supply (M3) accelerated further in the second quarter of 2020 as both financial and non-financial companies as well as households showed a preference for bank deposits amid uncertainty about the impact of the national lockdown on economic activity and financial markets. By contrast, growth in total loans and advances extended by monetary institutions to the domestic private sector continued to moderate in the second quarter of 2020 amid the sharp contraction in real GDP. The deceleration occurred despite substantial interest rate relief and a variety of measures aimed at easing liquidity conditions to alleviate the effects of the COVID-19 pandemic. The preliminary non-financial public sector borrowing requirement of R160 billion in the first quarter of fiscal 2020/21 (April–June 2020) far exceeded the R62.9 billion recorded in the same period of the previous fiscal year. This mainly reflected the notably larger cash deficit of national government, attributable to revenue shortfalls and higher transfers to other levels of general government for COVID-19-related expenditure. The response to COVID-19 was also evident in the change from a social security fund cash surplus in the first quarter of fiscal 2019/20 to a sizeable deficit in the first quarter of fiscal 2020/21. The financing of national government’s borrowing requirement led to a significant year-on-year increase of 18.7% in gross loan debt to 69.4% of GDP as at 30 June 2020. National government revenue contracted sharply by 22.8% year on year in the first four months of fiscal 2020/21, as all tax categories underperformed following the restrictions on economic activity to try and curb the spread of the COVID-19 pandemic. By contrast, total expenditure increased by 2.7% over this period, yielding a cash book deficit of R260 billion, which was R104 billion more than a year earlier.

Western Cape government calls for calm

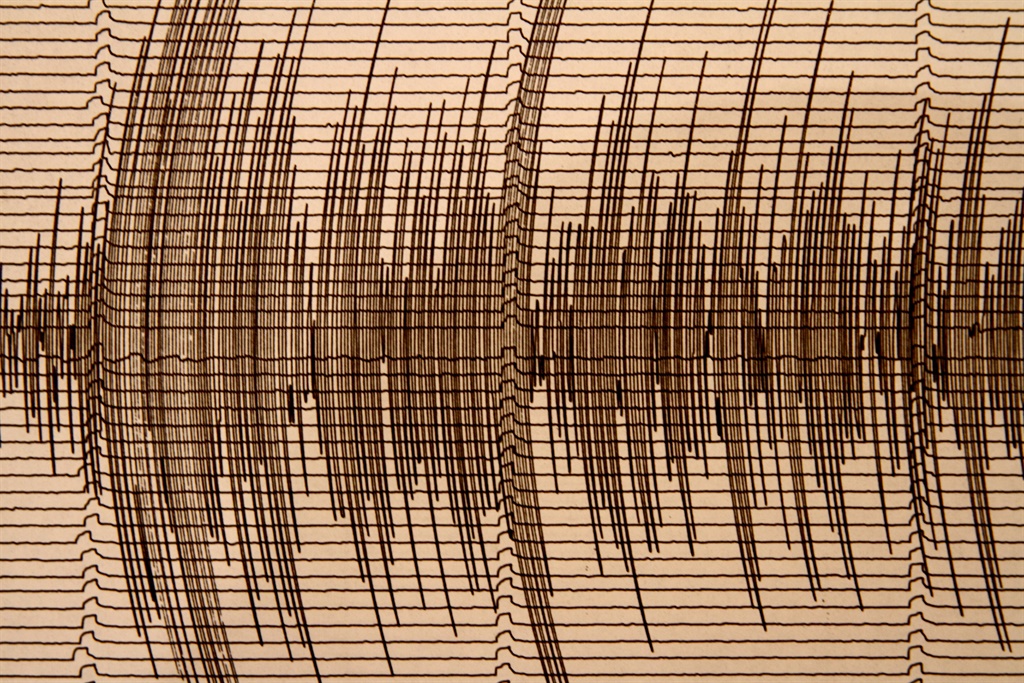

The Western Cape government said in a statement: …a magnitude 6.2 Earthquake struck approximately 1600 km south-east of South Africa. Following the event, tremors were felt in various Western Cape suburbs with no reports of casualties or damages to infrastructure, and no tsunami warning was issued.

Tremors were again experienced in several suburbs with no reports of casualties or damages to infrastructure, and no tsunami warning was issued.

The Council of Geoscience (CGS), have issued media statements pertaining to the tremors that occurred, urging the public not to panic as the are no imminent threats to public safety.

The CGS is the custodian of the South African National Seismograph Network which monitors seismic wave activities throughout the country.

According to the Council for Geoscience, the difference between an earthquake and an earth tremor lies in the magnitude of the event. Within the South African context, a seismic event with a magnitude lower than 4.0 is considered a tremor.

The Minister of Local Government, Environmental Affairs and Development Planning, Anton Bredell says recent seismic activity in Cape Town is no cause for panic.

“We’re fortunate in the fact that the African continent is on a very stable tectonic plate. We do not have major fault lines. Specifically, Southern Africa is on a very stable faultline. This means our risk for earthquakes and tsunamis are very low. While there is always some seismic risk, we don’t believe there is a real threat for a mega earthquake of seven or more on the Richter scale in the Western Cape. While we can never rule it out completely, the science doesn’t support it. It also bears noting that a 7 on the Richter scale is considered to be 33 times stronger than a 6.”

Bredell says the nuclear plant Koeberg, which would be most at risk to major seismic activity, was built to withstand a lot of seismic activity including being built on shock-absorbers.

“Furthermore, the Western Cape government, over the past ten years, has developed an excellent disaster response system to save people from trapped buildings in a disaster situation should the need arise. At the moment we have two caches of highly specialised rescue equipment.”

Western Cape disaster teams are often called to assist with global crises, gaining invaluable experience that can be applied locally.

Global news update at a glance:

Virus deaths top 971 000

The virus has killed at least 971 677 people since the outbreak emerged in China late last year, according to a tally from official sources compiled by AFP. More than 31.6 million cases have been confirmed.

The United States is the worst-hit country with 200 818 deaths, followed by Brazil with 138 108, India with 90 020, Mexico with 73 348 and the United Kingdom with 41 825.

Europe cases top five million

Europe has recorded more than five million infections, according to official sources, with a total of 5 000 421 cases now registered.

More than half of these were in Russia, followed by Spain, France and the United Kingdom.More than 380 000 new cases were reported in the past week, the highest number in the region since the start of the pandemic.

US-China spat

US President Donald Trump casts blame for the pandemic on China in an address before the United Nations, whose chief warns against a new “Cold War” between the two world powers.

Trump attacks Beijing and the UN for not stopping the disease and even uses the loaded term “China virus”.

China’s ambassador to the UN, Zhang Jun, tells reporters that Trump’s tone was “incompatible with the general atmosphere” of the world body.

“If we do have to hold anyone accountable, it should be the United States held accountable for losing so many lives with their irresponsible behaviour”, he says.

Stricter measures for Paris

The French government prepares to announce stricter measures for Paris, where infections have exploded since an end to lockdown.Ministers will hold two meetings – including one of the defence council – during the day to analyse the worsening situation.

Anti-flu drug

The maker of anti-influenza drug Avigan says it will apply for the medication to be approved for treating coronavirus patients after trials show it can shorten recovery time.

Manufacturer Fujifilm Toyama Chemical says its phase three trial in Japan, which began in March, is now complete.

– AFP

Defence Minister Nosiviwe Mapisa-Nqakula.

Deaan Vivier, Netwerk24

President Cyril Ramaphosa has cracked the whip, reprimanding and docking three months salary from defence minister Nosiviwe Mapisa-Nqakula pver the ANC junket to Harare on an airforce jet earlier this month.

In a statement late on Saturday, the presidency said that starting from November, Mapisa-Nqakula’s salary for the next three months would be paid to the Solidarity Fund.

“The President has further sanctioned the Minister by imposing a salary sacrifice on the Minister’s salary for three months, starting from 1 November 2020. Her salary for the three months should be paid into the Solidarity Fund, which was established to support the country’s response to the coronavirus pandemic,” the statement noted.

Ramaphosa took it a step further, indicating why he has taken tough action against the minister for her “error in judgment”.

“He (Ramaphosa) found that the Minister did not ‘act … in the best interest of good governance’ as required by the Executive Members Code, failed to adhere to legal prescripts warranting care in use of state resources (and) acted ‘in a way that is inconsistent with [her] position’ as required by the Code,” the statement noted.

An ANC delegation led by party secretary-general Ace Magashule flew to Zimbabwe on the South African National Defence Force (SANDF) dime, for a meeting with the ruling ZanuPF.

The SANDF defended this trip saying Mapisa-Nqakula travelled on official duty and gave the ANC delegation a lift. The ANC first denied there was an abuse of state resources but after Ramaphosa intervened and asked for a report within 48 hours from the minister, the party agreed to repay the cost of the fight.

“The President furthermore directed the Minister to make sure that the ANC reimburses the state for the costs of the flight to Harare and to report to him once that has been done,” the presidency said in its statement.

READ | SANDF chief was right to slam effort to lobby generals into ANC talks – deputy minister

Ramaphosa’s office said he considered two reports from Mapisa-Nqakula on the matter and found that it was “an error of judgment to use the plane to convey a political party delegation”.

“The President said that this error of judgment was not in keeping with the responsibilities of a Minister of Cabinet”.

Ramaphosa wrote to Mapisa-Nqakula reprimanding her saying that while he appreciated that the ANC had committed to pay back the cost of the flight, it was still an error of judgment which he took seriously.

“In his letter of reprimand to the Minister, President Ramaphosa said he appreciated that the ANC had committed to reimburse state resources spent in excess of those the Minister would have incurred for her approved travel to meet her Zimbabwean counterpart. However, the sanction imposed on the Minister demonstrated the seriousness with which the President viewed the Minister’s error of judgment, given her high position in government”.

The controversial flight is subject to two complaints before the public protector.

The DA has meanwhile estimated that the ANC would have to pay around R260 000 for the flight with the delegation including Magashule, Mapisa-Nqakula, Social Development Minister Lindiwe Zulu, Nomvula Mokonyane, Enoch Godongwana, Tony Yengeni and Dakota Legoete.